QuickBooks Online integration

Set up the Toggl Track integration with QuickBooks online

This integration is designed to send Track-specific invoices to QuickBooks Online. Utilizing Track invoices in this way will allow you to create QuickBooks invoices with less effort. Available for admins.

QuickBooks integration is a paid feature. It's available on Starter, Premium and Enterprise plans. Click here to for more info on pricing.

Activating QuickBooks Online

-

Navigate to the Integrations page.

-

Click on

Get startednext to the QuickBooks Online option.

-

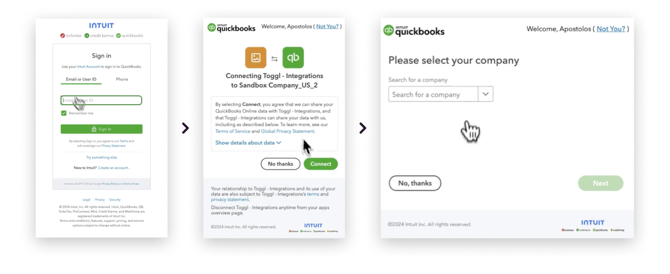

Follow the steps in the window that pops us. You might need to log in to QuickBooks and choose your company during this process.

Creating and sending an invoice to QuickBooks

-

Open Summary reports.

-

Select the appropriate time period and filters (Client, Project, etc).

-

Click on

Create invoicein the top-right corner. -

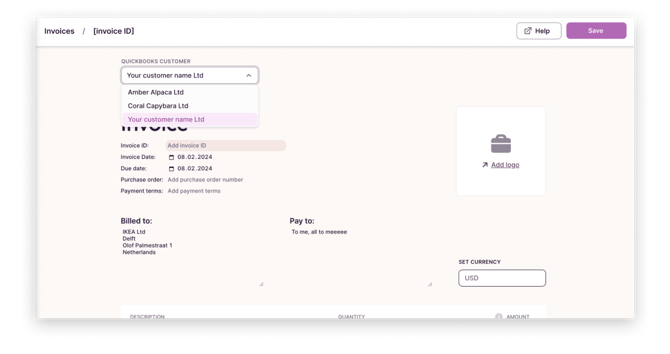

Make adjustments as needed.

-

Select the appropriate customer from QuickBooks, click Save & send" and finish editing the invoice on the QuickBooks side.

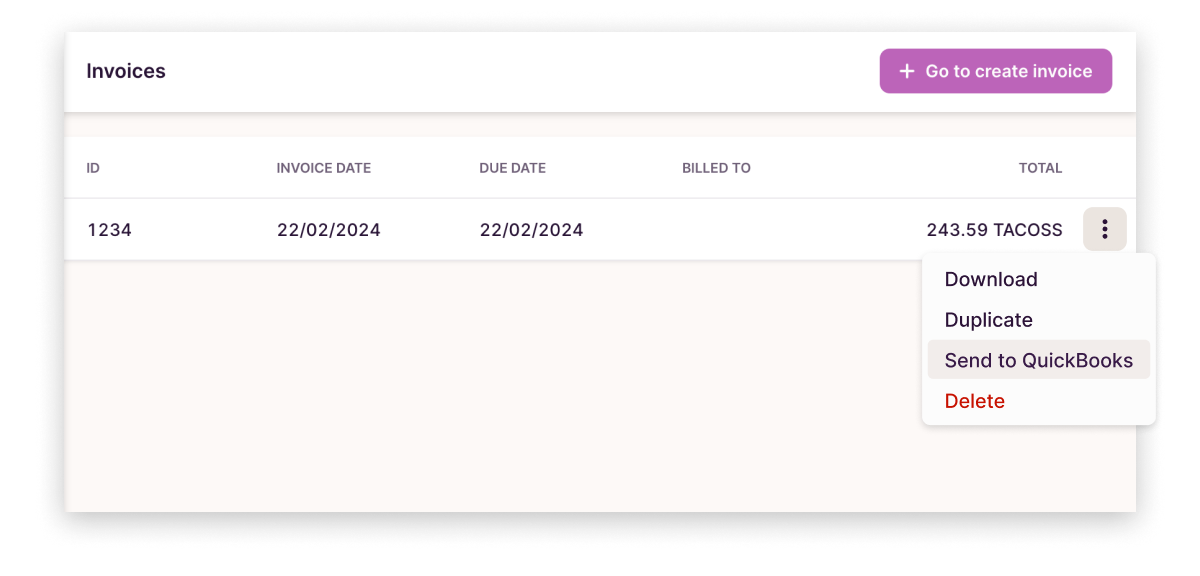

ℹ️ Any previously created Track invoices can be sent to QuickBooks from the Invoices page.

Video instructions for sending invoices to QuickBooks

Important notes:

-

The Track invoice and the QuickBooks invoice are not directly connected. Updating one will not update the other. If same invoice is sent twice from Track it will create separate invoices on QuickBooks side.

-

Taxes, currency, billed to, pay to fields are handled on QuickBooks side and do not need to be filled in.

-

Being logged in to QuickBooks is necessary for the "Send to QuickBooks" option to work as expected. If you land on a blank invoice in QuickBooks (after using the integration), it's likely because you were interrupted by the Sign in process.

-

QuickBooks integration was available to all Track users following the initial release, but since October 17, 2024 it requires a paid plan to access.